Support for creating VAT and statements AE038

General description #

This module contains tools facilitating the creation of VAT, government and corporate reports.

VAT statements overview #

A new list VAT Statement List and card VAT Statement Card are added in this module.

Apart from the general functions and information in the header on the VAT Statement Card, new settings are availible on the page report settings, while using the report for VAT statement Export.

Standard Processes and Actions such as Release, Reopen, Post, among others, are availible on the VAT Statement Card.

Moreover the following Actions are availible:

-

Suggest Lines

- On the VAT Statement Card, it is possible to use the function Suggest Lines. This function generates and calculate lines for the specific statement according to the settings on VAT Statement Setup and VAT Statement. Before the lines are generated, the existing lines are deleted and unapplied from VAT Entries.

- Action Preview can be used on the VAT Statement page. The amounts should correspond with the amounts on the card.

-

VAT Entry Summarization

- On the VAT Statement Card, a report VAT Entry Summarization can be run, grouping the entries by VAT Positng groups.

- The report can be printed listing all entries or group entries by document number - action Group details by Document No..

- The entries can be grouped by VAT posting goups and display only amounts for the VAT groups Only Summarization Lines.

-

Function Export

- This action (Process - Export) creates XML file, based on current system settings and current data saved in relevant tables.

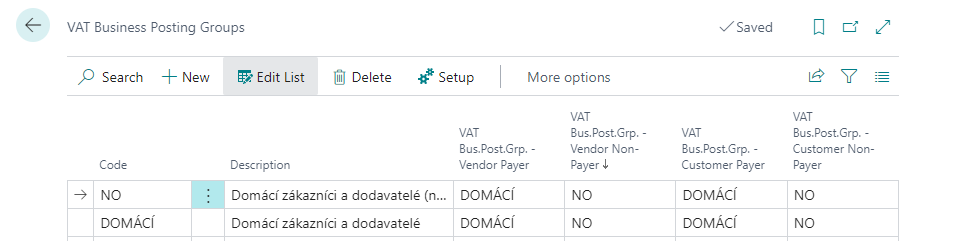

Change in VAT Business Posting Groups regarding VAT payer/non-payer #

In order to distinguish customers/vendors who are VAT registered (payers) among those who are not registered VAT payers (non-payers), the filed Customer/Vendor VAT Bus. Posting Group is used. There are different VAT Bus. Posting Groups used for registered VAT payers and for those who are not VAT payers. In case of need, further diferentiation can be made by using Customer/Vendor Posting Group. The filed Customer/Vendor VAT Bus. Posting Group will be automatically adjusted/changed on the background while changing/adding/errasing the field VAT Registration No. This change will not affect any existing documents (both posted and not posted).

The VAT Registration No. can be filled out on the Customer/Vendor Card.

- Filling in the field VAT Registration No. or not, determines, whether the Customer/Vendor is VAT registered payer or not. Based on this action, the fieled VAT Business posting group is set.

- When changing the value in the filed VAT Reg. No. from blank to filled (or viceversa) the field Customer/Vendor VAT Business Posting Group is changed according to the setting.

- The swapped groups are set in VAT Business Posting Groups. For each group there are 4 fileds to be set: for VAT Payer Customers, VAT Non-payer Customers, VAT Payer Vendors and VAT Non-payer Vendors.

In case the VAT No. is a VAT group, the document posting is forbiden.

VAT Control Report Extension and VAT Registration No. loading #

A VAT Control Report could be generated from the newly created VAT Control Report Card. After filling in the period No., and specifying the corresponding VAT Satement (which will include a right configuration of bonds between VAT posting groups and VAT Control Report section), it will be possible to generate VAT Control Report Lines. In order to make the analysis of the VAT Control Report lines easier, it will be possible to suggest merged lines A5 and B3 broken down into individual document entries.

It will be possible to manually change a VAT report section of each entry, in case this was incorrectly defined. In case there is a entry on the VAT Control Report, which should not be listed on the reposrt, it will be possible for user to exclude this entry from the exported data. The VAT Control Report could be released and exported after the user check of the suggested VAT Control Report. It will be possible to fill in all the necessary identification data and choose a declaration type of expoerted VAT Control Report (recapitulative, corrective, supplementary) during the export action.

Exclusion of internal cancellations of posted documents #

There is a function to exlude internal cancellations of posted documents from the VAT Control Report. The documents which were cancelled/cancel other posted documents will be automatically excluded from the export in VAT Control Report.

These excluded documents are being saved in the table Cancelled documents, which is accessible and editable by the user.

Users can edit or create new records. There are no checks/controls of connections and amounts of those documents, which were linked together in order to be cancelled. This is up to the user.

- Ii is possible to manually enter the posted sales invoice number as well as posted sales credit memo number in Cancelled documents.

- Cancelled documents are automatically created while using the funcion Cancel availible on the posted invoice.

-

In the VAT Control Report Section, there is a checkbox Automatically exclude canceled documents. If the checkbox is ticked, cancelled documents are automatically marked as Cancelled and Exclude from export while creating the VAT Control Report (in VAT Control Report Lines).

- The lines, marked as described above, are not inclueded in the export.

Change in section A4/A5 and B2/B3 according to the VAT Registration No. #

The way of suggesting VAT Control Report is modified in the following way: A document will be automatically shiffed from the section A4 (resp. B2) to the section A5 (resp. B3) in case there is no VAT Registration No. in the document.

- Documents where the total amount exceeds 10 000,- incl. VAT, without VAT Registration No. of the subject, are automatically classified in the section A5 (resp. B3).

- In the VAT Control Report, it is possible to manually add the VAT Registration No. and manually change the section of the entry.

Control of filling in VAT Registration No. #

In case the value VAT_Group is filled in the field VAT Registration No. on the Customer/Vendor Card, like while downloading data from ARES for instance, the field is automatically overwritten with previous value.

Added reports #

-

Post. Transaction Statement

- The report can be run from te page G/L Registers

- Allows to view the details of the posted transactions.

- Overview of the sales credit memos with postponed VAT

- Calcutate and post VAT statement settlement

VAT entries #

Original VAT #

The following settings need to be done in order to activate this functionality.

There are new columns added in VAT Entries, displaying the amounts of the original currency before posting.

- Original Currency Amount - the amount is maintained in the currency from the source line from general journal

- Original Currency Code - the currency code is maintained from the source line from general journal

-

Original Exchange Rate - the exchange rate is maintained from the source line from general journal

- According to

Base Amount for VAT ÷ Base Amount for VAT in original currency - Accuracy to (

0.01) - In case the source line from general journal is in local currency, the exchange rate is

1

- According to

- Original currency base - the base amount is mantained from the source line from general journal

VAT Date change #

In case of open purchase invoice, it is possible to change the VAT Date, using the action Change VAT Date. It is required that user is allowed to change the VAT Date in User Setup.

New fileds added #

-

Account Schedules

-

Row No. for Printing

- Availible while changing account schedule (page Account Schedules -> Process -> Edit Account Schedule).

- Taken into account in reports added in this module.

-

Correction

- Availible while choosinng column layout (page Account Schedules -> Process -> Edit Column Layout Setup).

- Permits to mark correction column for balance sheet.

- The correction column is calculated according to correction series.

-

Row No. for Printing

Settings #

The following settings are added, extended and used in this module:

-

Statutory Reporting Setup

- VAT Statement Nos. - category VAT Statement

-

Calculation Max Level - category Representative -> Account Schedules

- Allows to edit a maximum depth while processing formulas

-

Include documents without VAT ID in the simplified section - category VAT Control Report

- Activates automatic control report section comutation in case when there is no Registration No. for an entry and if there is a simplified section for this specific section.

-

General Ledger Setup

- Calculate VAT Entry Original values - category General

-

VAT Report Setup

-

The job queue is automatically scheduled during the installation process of the extension. The job will try to automatically filled in the settings (data to the day 10.2.2022)

- It is possible to also plan this job queue manually -

Codeunit 79205

- It is possible to also plan this job queue manually -

- The job can be triggered both by looking up or clicking action on the page VAT Statement Templates (Related -> Template -> Lines Setup)

- Permits to create a structure of lines for VAT Statement card, by mapping atributes into rows and columns

- The setting is bounded to VAT Statement Names

-

The job queue is automatically scheduled during the installation process of the extension. The job will try to automatically filled in the settings (data to the day 10.2.2022)

-

VAT statements

- Basic, functionality not modified

- It is necessary to choose corresponding atributes to each No. series, in order to include VAT Entries created

-

User Setup

- It is possible to set, if a user has rights to change VAT Date in VAT Entries.

It is necessary to set exchagable groups in VAT Business Posting Groups list. For a group VAT Vendor Payer - a correspondig group Non-payer is set and viceversa. The setting is divided in groups Vendors and Customers.